return (

Introduction to the Metropolis Stock Exchange (MSC)

Overview of MSC

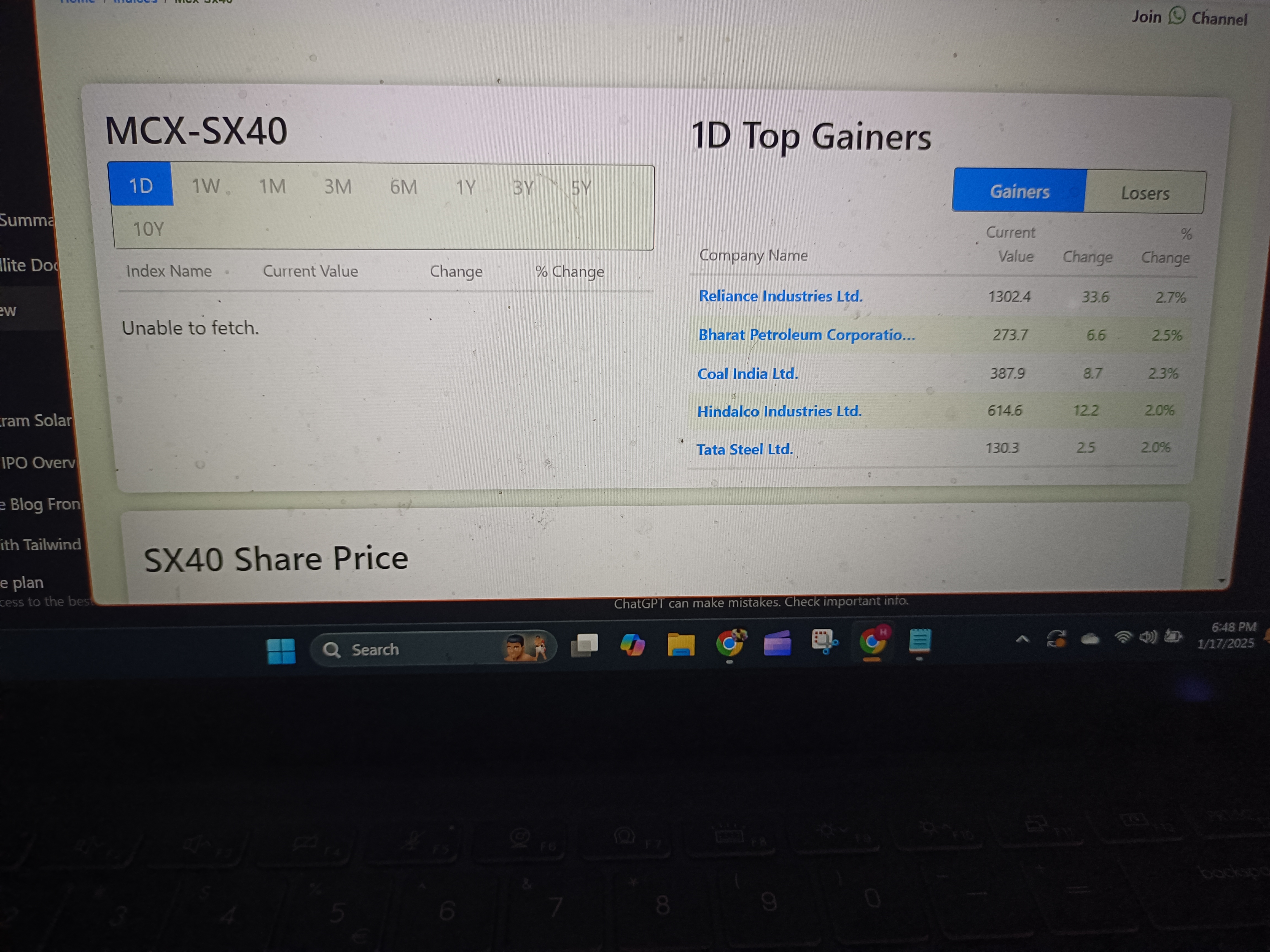

The introduction of the Metropolis Stock Exchange (MSC) marks a new era for Indian financial markets. Like the NSE (Nifty 50, Nifty Bank) and BSE (Sensex, Bankex), MSC brings two primary indexes:

- SX40: Representing the top 40 large-cap companies.

- SX Bank: Focused on banking sector stocks.

SX40 Index Companies

| Company Name | Current Value (₹) | Change (₹) | % Change |

|---|

| Housing Development Finance Corporation Ltd. | 2724.3 | 0 | 0.0% |

| Cipla Ltd. | 1442.5 | -1 | -0.1% |

| Bharat Heavy Electricals Ltd. | 214 | 3.3 | 1.6% |

| Titan Company Ltd. | 3360 | 40.8 | 1.2% |

| Dr. Reddy's Laboratories Ltd. | 1309.9 | 6.5 | 0.5% |

| HDFC Bank Ltd. | 1636.7 | -16.1 | -1.0% |

| Hero MotoCorp Ltd. | 4096.9 | 23.4 | 0.6% |

| Infosys Ltd. | 1815.5 | -110.8 | -5.7% |

| Lupin Ltd. | 2112.6 | 13.2 | 0.6% |

| Oil & Natural Gas Corporation Ltd. | 266.5 | 3.3 | 1.2% |

| Reliance Industries Ltd. | 1302.4 | 33.6 | 2.7% |

| Tata Power Company Ltd. | 373.7 | 4.7 | 1.3% |

| ACC Ltd. | 2013.1 | 25.6 | 1.3% |

| Ambuja Cements Ltd. | 536.1 | -3.7 | -0.7% |

| Hindalco Industries Ltd. | 614.6 | 12.2 | 2.0% |

| Tata Steel Ltd. | 130.3 | 2.5 | 2.0% |

| Larsen & Toubro Ltd. | 3568.5 | 56.1 | 1.6% |

| Mahindra & Mahindra Ltd. | 2918 | -62.9 | -2.1% |

| Bharat Petroleum Corporation Ltd. | 273.7 | 6.6 | 2.5% |

| Tata Motors Ltd. | 779.4 | 5 | 0.6% |

| Hindustan Unilever Ltd. | 2354.3 | 8.3 | 0.4% |

| Asian Paints Ltd. | 2259.7 | 43.3 | 2.0% |

| ITC Ltd. | 440.2 | 7.3 | 1.7% |

| Zee Entertainment Enterprises Ltd. | 121.4 | -1.4 | -1.1% |

| Wipro Ltd. | 281.9 | -6.2 | -2.2% |

| Sun Pharmaceutical Industries Ltd. | 1786.2 | 22.7 | 1.3% |

| GAIL (India) Ltd. | 181 | 0.4 | 0.2% |

| ICICI Bank Ltd. | 1225.9 | -23.9 | -1.9% |

| HCL Technologies Ltd. | 1789.6 | -2.2 | -0.1% |

| Jindal Steel & Power Ltd. | 923.8 | 6.6 | 0.7% |

| United Spirits Ltd. | 1424.8 | 10.2 | 0.7% |

| Bharti Airtel Ltd. | 1627.4 | -4 | -0.2% |

| Maruti Suzuki India Ltd. | 12110 | 16.3 | 0.1% |

| Jaiprakash Associates Ltd. | 5.7 | 0 | 0.0% |

| Tata Consultancy Services Ltd. | 4125.7 | -82.4 | -2.0% |

| NTPC Ltd. | 326.4 | 0.8 | 0.2% |

| Power Grid Corporation Of India Ltd. | 302.6 | 4.9 | 1.6% |

| Bajaj Auto Ltd. | 8586.8 | 7.1 | 0.1% |

| Coal India Ltd. | 387.9 | 8.7 | 2.3% |

// pages/index.js import Head from 'next/head'; return (

Introduction to the Metropolis Stock Exchange (MSEI)

What is SX40?

SX40 is the flagship index of MSEI, encompassing 40 large-cap companies from diverse industries. These companies represent a cross-section of India's leading sectors, making it a significant benchmark for market performance.

Companies Included in SX40

- Bharat Heavy Electricals Ltd. (BHEL)

- Ambuja Cement

- Oil and Natural Gas Corporation (ONGC)

- Indian Oil Corporation

- Reliance Industries

- Bharti Airtel

- Infosys

- Larsen & Toubro (L&T)

- HDFC Bank

- Tata Steel

- ICICI Bank

- HCL Technologies

- Tata Power

Trading Insights

The index has recently observed a price movement between 10.6 and its peak levels. Despite a lack of disclosed data from SEBI about options and lot sizes, trading activity in SX40 has noticeably increased.

Top gainers and market trends for the SX40 index can be tracked on platforms like ShareChat.com and others.

What is A4?

A4 is part of the broader market activity within the MSEI. With over 2000 listed companies, MSEI has streamlined 200 prominent companies into trading under A1 40, which includes A4. This share is gaining attention for its performance metrics and potential returns.

Current Trading Insights for A4

- Trading Price: A4's current market price hovers around ₹12.50 to ₹12.75.

- Weekly High: The share has hit a recent high of ₹12.75.

- Long-Term Target: Analysts predict that A4 may reach a target of ₹1850 within 2-3 weeks, representing a 70.8% potential return.

- Future Potential: Long-term projections suggest the share could even exceed ₹200, contingent on IPO developments and market conditions.

Why Consider A4?

A4 shows promise for both short-term gains and long-term growth. Positive market sentiment supports steady growth and increasing investor interest.

- High Growth Potential: A4 is poised for significant returns.

- Upcoming IPO: While the IPO date remains unannounced, its eventual listing could boost valuation.

- Investment Tips: Holding A4 below ₹12 is advisable, with a target of ₹1850 in the short term.

History and Challenges of MSCI

The MSCI was launched in 2008 to compete with NSE and BSE, ensuring fair pricing in a market dominated by these players. Despite initial hurdles like NSE's monopoly, minimal revenues, and infrastructure challenges, MSCI is now thriving due to strategic shifts.

Why MSCI is Thriving Now

- Regulatory Changes by SEBI: New rules limiting weekly expiries to one per exchange have redirected trading activity toward MSCI.

- Broker Investments: Leading brokers have invested ₹2,240 crore into reviving MSCI's operations.

- Growing Investor Base: The increase in demat accounts from 4 crore in 2018 to 16 crore in 2024 has created new opportunities.

Investor and Broker Interest

News of MSCI's revival triggered a surge in demand, driving its unlisted share price from ₹2 to ₹12 within six months. Big brokers are now investing in infrastructure and software to enhance MSCI's capabilities.