return (

Introduction to the Metropolis Stock Exchange (MSC)

Overview of MSC

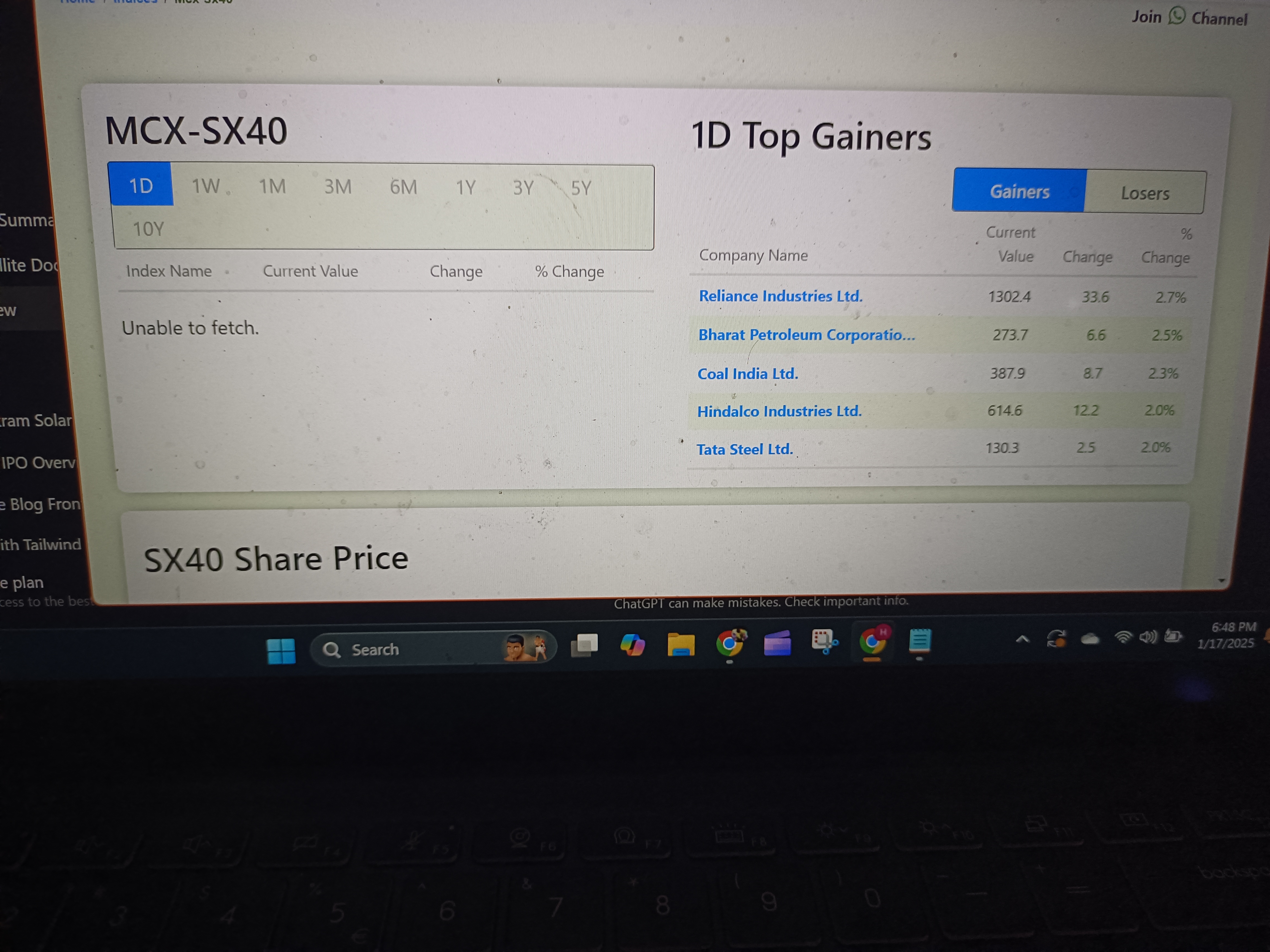

The introduction of the Metropolis Stock Exchange (MSC) marks a new era for Indian financial markets. Like the NSE (Nifty 50, Nifty Bank) and BSE (Sensex, Bankex), MSC brings two primary indexes:

- SX40: Representing the top 40 large-cap companies.

- SX Bank: Focused on banking sector stocks.

SX40 Index Companies

| Company Name | Current Value (₹) | Change (₹) | % Change |

|---|

| Housing Development Finance Corporation Ltd. | 2724.3 | 0 | 0.0% |

| Cipla Ltd. | 1442.5 | -1 | -0.1% |

| Bharat Heavy Electricals Ltd. | 214 | 3.3 | 1.6% |

| Titan Company Ltd. | 3360 | 40.8 | 1.2% |

| Dr. Reddy's Laboratories Ltd. | 1309.9 | 6.5 | 0.5% |

| HDFC Bank Ltd. | 1636.7 | -16.1 | -1.0% |

| Hero MotoCorp Ltd. | 4096.9 | 23.4 | 0.6% |

| Infosys Ltd. | 1815.5 | -110.8 | -5.7% |

| Lupin Ltd. | 2112.6 | 13.2 | 0.6% |

| Oil & Natural Gas Corporation Ltd. | 266.5 | 3.3 | 1.2% |

| Reliance Industries Ltd. | 1302.4 | 33.6 | 2.7% |

| Tata Power Company Ltd. | 373.7 | 4.7 | 1.3% |

| ACC Ltd. | 2013.1 | 25.6 | 1.3% |

| Ambuja Cements Ltd. | 536.1 | -3.7 | -0.7% |

| Hindalco Industries Ltd. | 614.6 | 12.2 | 2.0% |

| Tata Steel Ltd. | 130.3 | 2.5 | 2.0% |

| Larsen & Toubro Ltd. | 3568.5 | 56.1 | 1.6% |

| Mahindra & Mahindra Ltd. | 2918 | -62.9 | -2.1% |

| Bharat Petroleum Corporation Ltd. | 273.7 | 6.6 | 2.5% |

| Tata Motors Ltd. | 779.4 | 5 | 0.6% |

| Hindustan Unilever Ltd. | 2354.3 | 8.3 | 0.4% |

| Asian Paints Ltd. | 2259.7 | 43.3 | 2.0% |

| ITC Ltd. | 440.2 | 7.3 | 1.7% |

| Zee Entertainment Enterprises Ltd. | 121.4 | -1.4 | -1.1% |

| Wipro Ltd. | 281.9 | -6.2 | -2.2% |

| Sun Pharmaceutical Industries Ltd. | 1786.2 | 22.7 | 1.3% |

| GAIL (India) Ltd. | 181 | 0.4 | 0.2% |

| ICICI Bank Ltd. | 1225.9 | -23.9 | -1.9% |

| HCL Technologies Ltd. | 1789.6 | -2.2 | -0.1% |

| Jindal Steel & Power Ltd. | 923.8 | 6.6 | 0.7% |

| United Spirits Ltd. | 1424.8 | 10.2 | 0.7% |

| Bharti Airtel Ltd. | 1627.4 | -4 | -0.2% |

| Maruti Suzuki India Ltd. | 12110 | 16.3 | 0.1% |

| Jaiprakash Associates Ltd. | 5.7 | 0 | 0.0% |

| Tata Consultancy Services Ltd. | 4125.7 | -82.4 | -2.0% |

| NTPC Ltd. | 326.4 | 0.8 | 0.2% |

| Power Grid Corporation Of India Ltd. | 302.6 | 4.9 | 1.6% |

| Bajaj Auto Ltd. | 8586.8 | 7.1 | 0.1% |

| Coal India Ltd. | 387.9 | 8.7 | 2.3% |

// pages/index.js import Head from 'next/head'; return (

If you visit our website and search for MSCI shares, you'll see significant growth in the stock price. Over the last six months, the stock has gone from ₹1 to ₹12, marking a remarkable 12x growth.

In this blog, we'll explore the reasons behind this growth and analyze MSCI’s future prospects.

The History of MSCI

MSCI was established in 2008 by NSC to compete with BSE. The idea was to provide investors with more options in the market, as monopoly or duopoly scenarios often lead to less competitive prices.

However, MSCI struggled to establish itself against NSC and BSE. NSC held a monopoly in the F&O (Futures and Options) market, which contributed significantly to its revenue. MSCI's attempts to launch new products were consistently overshadowed by NSC’s dominance. As a result, MSCI's performance remained negligible.

MSCI’s Performance Over the Years

- Revenue: ₹10 crores (2023), ₹9 crores (2024), ₹7 crores (2024).

- Losses: ₹31 crores (2023), ₹30 crores (2024), ₹18 crores (2024).

- Negative reserves in the balance sheet.

- No significant investor participation in the cash and F&O markets.

Recent Market Context and Developments

Over the past four years, the number of demat accounts has surged from 4 crores to 16 crores, leading to an influx of retail investors in the market. Most of their activity has been in the F&O market. However, SEBI’s recent regulations aim to curb F&O activity:

- From November 2024, exchanges like NSC and BSE can only have two weekly expiries.

- Brokers like Groww, Angel Broking, and Motilal Oswal, whose income heavily relies on F&O, faced challenges due to the reduction in expiries.

- Big brokers decided to revive MSCI, leveraging its existing F&O index (SX40) to facilitate weekly expiries and generate volumes.

Revival Efforts and Investments

Major players have invested ₹2,240 crores into MSCI to revive its operations. The news was widely covered by outlets like Business Standard, Money Control, Zee News, and CNBC, leading to a surge in investor interest. This demand drove the stock price from ₹2 to ₹12 in the unlisted market.

Future Prospects of MSCI

The future of MSCI depends on several factors:

- Development of robust software and infrastructure to handle higher volumes.

- Recruitment of skilled personnel for management and operations.

- Ability to attract and sustain significant trading volumes.

- Market capitalization, which currently stands at ₹7,200 crores, has potential for substantial growth if MSCI performs well.

While MSCI's revival shows promise, its success will depend on how efficiently it can adapt to market demands and regulatory changes.

Conclusion

MSCI's recent growth from ₹2 to ₹12 is driven by strategic investments and renewed interest in the exchange. However, its long-term success hinges on its ability to handle volumes, build infrastructure, and attract traders. Investors should carefully evaluate these factors before making decisions.